How an ambiguous legal definition is endangering nonprofits’ control of dozens of affordable housing developments in the final years of their tax credit agreements.

For the past five years or so, dozens of nonprofits across the country have found themselves embroiled in costly litigation spawned from the ambiguity of the Low-Income Housing Tax Credit program’s right of first refusal provision. At stake is whether they can, as is standard, take ownership of the properties and maintain their affordability as investors exit, without having to pay market prices.

A recent court victory for the Opa-Locka Community Development Corporation (OLCDC), a nonprofit affordable housing provider in Florida, may set a useful precedent in clarifying that provision. But the road there wasn’t easy, and a legislative fix will probably still be needed.

LIHTC and the Right of First Refusal

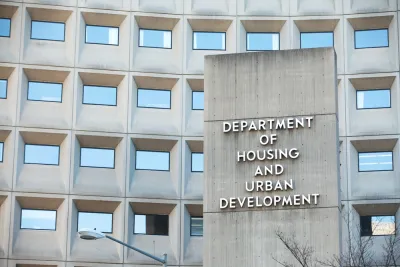

The LIHTC program is the largest funding source for affordable housing in the United States. According to the U.S. Department of Housing and Urban Development (HUD), it created over 3.2 million affordable housing units from 1987 to 2018. The federal government allocates tax credits to each state based on population. Developers can then apply for these tax credits to build affordable housing. However, most nonprofit developers are not required to pay taxes. So instead of utilizing it themselves, they sell the tax credits to investors who are often large financial institutions. In return, the LIHTC developer gets a large lump sum that they can use to cover the costs of construction.

The LIHTC program requires that affordability be preserved in these developments for 30 years. Investors that do not comply could have their tax benefits recaptured by the IRS, although enforcement of this provision typically ends in year 15. Investors can utilize the tax credits in the first 10 years, but ownership of LIHTC properties typically changes in year 15, when the investor will no longer be at risk for tax credit recapture.

LIHTC deals are limited partnerships. When an investor pays for the tax credit, they become a limited partner, meaning they invest money into a project but do not oversee the day-to-day management of the property. The nonprofit developer uses the money it makes from the sale of those tax credits to finance the costs of construction. The nonprofit becomes the general partner, which oversees the daily operation of the property and has unlimited liability for the financial wellbeing of the partnership.

Integral to this transition is something called a right of first refusal (ROFR). However, there has been contention around the definition and triggering conditions of the LIHTC program’s ROFR provision.

The Rise of Aggregators

This ambiguity made LIHTC deals fertile grounds for predatory entities known as “aggregators,” which buy investor interests in LIHTC developments that they expect could fetch a significant price on the market. They then dispute the transfer of property ....

FULL STORY: Losing Nonprofit Control of Tax Credit Housing?

Analysis: Cybertruck Fatality Rate Far Exceeds That of Ford Pinto

The Tesla Cybertruck was recalled seven times last year.

National Parks Layoffs Will Cause Communities to Lose Billions

Thousands of essential park workers were laid off this week, just before the busy spring break season.

Retro-silient?: America’s First “Eco-burb,” The Woodlands Turns 50

A master-planned community north of Houston offers lessons on green infrastructure and resilient design, but falls short of its founder’s lofty affordability and walkability goals.

Test News Post 1

This is a summary

Analysis: Cybertruck Fatality Rate Far Exceeds That of Ford Pinto

The Tesla Cybertruck was recalled seven times last year.

Test News Headline 46

Test for the image on the front page.

Urban Design for Planners 1: Software Tools

This six-course series explores essential urban design concepts using open source software and equips planners with the tools they need to participate fully in the urban design process.

Planning for Universal Design

Learn the tools for implementing Universal Design in planning regulations.

EMC Planning Group, Inc.

Planetizen

Planetizen

Mpact (formerly Rail~Volution)

Great Falls Development Authority, Inc.

HUDs Office of Policy Development and Research

NYU Wagner Graduate School of Public Service